The introduction of South Africa’s new AARTO regulations on December 1 is creating not just a regulatory shift, but also a perfect storm for digital fraudsters. As government agencies scramble to educate the public and iron out operational wrinkles, scammers are exploiting the confusion with increasing sophistication.

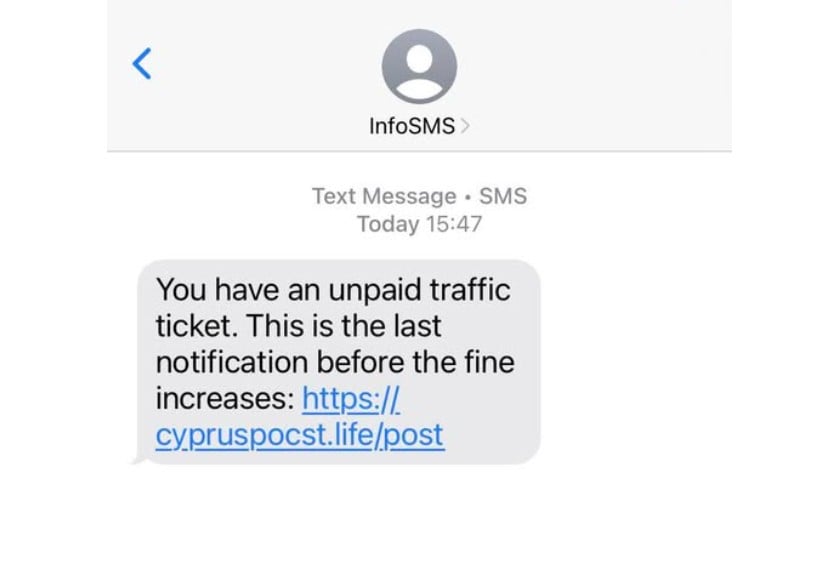

The volume of fraudulent “ghost fine” scams is rising fast—these schemes are now a serious risk for anyone who drives in South Africa. Let’s break down exactly what’s happening here. The typical scam looks deceptively official: you receive a text message or WhatsApp from what appears to be a municipal authority.

The branding is slick, the language sounds authentic, and there’s a link to ‘pay your fine immediately to avoid penalties’. But behind the façade, these are criminal operations. Victims are directed to cloned websites that capture their payment information. Once a payment is made, the funds are lost and the motorist still owes the original fine.

Looking for a safe car for a student then click here

The scam preys on people’s uncertainty about the new rules and the pressure to stay compliant before AARTO enforcement begins. According to Fines SA, there’s been a dramatic uptick in these complaints.

Barry Berman, CEO of Fines SA, describes the current landscape as a “scam epidemic.” The urgency created by AARTO’s looming enforcement is driving more people to act without verifying information—an ideal environment for social engineering. It’s not just about losing a few hundred rand; these scams can result in significant financial losses, not to mention the frustration and reputational risk for businesses managing fleets.

It’s important to recognize this isn’t happening in a vacuum. South Africa’s broader digital fraud landscape is also seeing explosive growth. The South African Banking Risk Information Centre (SABRIC) reports digital banking fraud made up more than 65% of fraud cases in 2024, doubling in just a year. Losses exceeded R1,4-billion.

Starting or running a small business and in need of a bakkie – click here

What’s driving this isn’t technical wizardry or big data breaches—it’s old-fashioned trickery, exploiting people’s trust and lack of awareness. Globally, phishing attacks are following the same trajectory and Kaspersky’s 2024 data shows a 26% increase in blocked phishing attempts worldwide.

In South Africa, targeted phishing against business users jumped by 134% quarter-over-quarter. The lesson here is clear: whether you’re a private motorist or managing a fleet, the digital threat landscape is evolving rapidly, and criminals are getting bolder.

Need finance – click here for the very best finance deals for your new car

The situation with AARTO only makes things more complex. The new demerit system means every fine now has direct legal and financial consequences—accrue enough points, and you could face license suspension or cancellation. Yet public understanding of AARTO is still low, and inconsistent communication from authorities has created fertile ground for scammers to manipulate people’s fear and uncertainty.

This is where platforms like Fines SA play a vital role. Their business model is built around security, transparency and convenience. By aggregating fine data from more than 250 municipalities and integrating secure payment options—PayFast, SnapScan, Zapper, Apple Pay, among others—Fines SA creates a single verified channel for motorists and fleet operators.

Payments are routed directly to municipal accounts, eliminating the risk of misdirected or fraudulent payments. Features like real-time notifications, consolidated reporting and access to support services transform what was once a fragmented, opaque process into something far more manageable and trustworthy.

Crunch the numbers by using this handy Finance Calculator

From a business perspective, this isn’t just about compliance—it’s about risk mitigation and operational efficiency. Fleet operators depend on platforms like Fines SA to maintain their legal standing, avoid costly disruptions and protect their brand reputation from association with fraudulent activity. For individual motorists, the peace of mind that comes from using a verified service with a track record matters. The numbers speak for themselves: 1,5-million users and a 4,7-star rating based on more than 2 000 independent reviews.

Barry Berman’s advice is grounded in pragmatism: take a few moments to verify before making any payments. This isn’t just good personal practice; it’s a sound business principle. The cost of falling for a scam can be substantial, especially as regulatory enforcement tightens and penalties increase under AARTO.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS

Images: Arrive Alive