Developing competitive new vehicles presents an ongoing challenge for manufacturers, requiring careful balancing of pricing and standard features to meet evolving consumer expectations. Success in the current motor industry hinges not solely on lowest cost or maximum features, but on delivering a compelling value proposition. A Jato analysis of Germany's car market over the past decade illustrates this complex dynamic.

Key Findings from German Market Analysis (2015-2024):

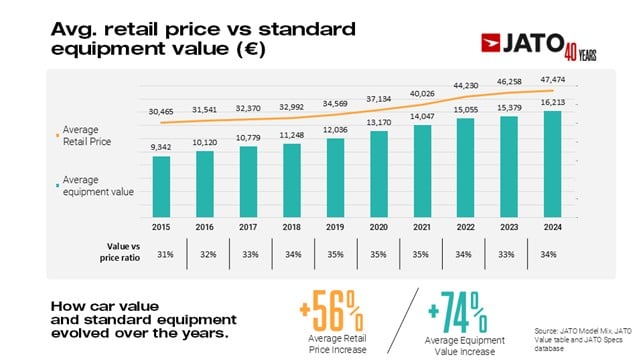

- Rising Costs and Enhanced Content: The average retail price for passenger cars in Germany climbed by 56% over 10 years. Concurrently, the economic value attributed to standard vehicle equipment increased by a more substantial 74%, indicating significantly enhanced feature levels in newer models.

- Technology Drives Value: Technological features, particularly safety systems (including Advanced Driver Assistance Systems - ADAS), connectivity, and infotainment, have markedly increased their contribution to a vehicle's overall perceived value. Regulatory requirements and consumer demand have propelled this shift.

- Brand Positioning Through Equipment: Traditional mainstream car brands offer a content-to-price ratio averaging 37%, while traditional premium brands sit near 28%, leveraging brand prestige to justify higher pricing. Newcomer brands, however, consistently deliver a higher value-for-money ratio of 44%-45%, achieved through lower list prices and richer standard specifications.

- Dacia's Distinct Approach: Dacia employs a unique strategy, maintaining notably lower list prices. This results in a value-for-money ratio approaching 50%, a key factor contributing to the Dacia Sandero achieving the highest sales volume in Europe during 2024.

The Dacia example can be directly compared to the situation in South African where incoming Chinese brands are achieving the same thing.

For the very best overall deal just click here

Price Versus Value Trajectory

The average German passenger car price rose from approximately R610 000 (€30 500) in 2015 to around R950 000 (€47 500) in 2024, influenced by factors like general inflation, new powertrain technologies (electrification) and semiconductor supply constraints.

Alongside price hikes, vehicles gained numerous new features: improved safety standards, emerging technologies and more prevalent design elements like ambient interior lighting and synthetic leather upholstery.

Starting or running a small business and in need of a bakkie – click here

Using JATO Dynamics' value analysis methodology, which assigns economic value to vehicle features, the average value of standard equipment surged by 74% over the decade. This indicates that equipment levels grew considerably faster than prices. The value-to-price ratio improved until 2019, signifying price rises were matched by tangible product enhancements. However, this ratio has stabilised or slightly declined over the challenging past five years.

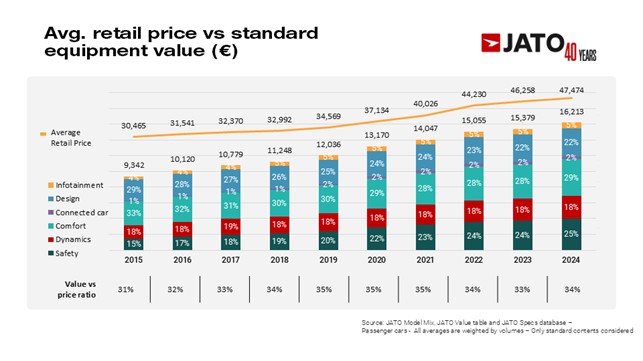

Shifting Feature Priorities

Analysis categorising value into six groups reveals technology's dominance:

- Safety (including ADAS): Value contribution grew significantly, moving from fourth to second place in importance, partly driven by European regulations.

- Connectivity & Infotainment: Also increased substantially in relevance.

- Design & Comfort: While their absolute value increased, their relative weight in the overall car value decreased.

- Dynamic Characteristics: Remained relatively stable.

This shift reflects changing consumer interests towards technological features like ADAS, large entertainment screens, and connectivity – areas strongly emphasised by newcomers like Tesla and emerging Chinese manufacturers.

Brand Strategies: Traditional vs Newcomers

While overall market averages provide insight, brand strategies differ markedly:

- Traditional Mainstream: Average content-to-price ratio: 37%.

- Traditional Premium: Average ratio near 28%, relying more on brand prestige.

- Newcomers (Mainstream & Premium): Deliver a 44%-45% ratio via lower prices and richer standard equipment.

Need finance – click here for the very best finance deals for your new car

Newcomers frequently offer more advanced technology as standard (eg, wider infotainment screens, electric seat adjustment, parking assistance, autonomous driving functions) and tangible design features like synthetic leather seats or glass roofs. Traditional manufacturers currently hold an edge in connectivity solutions, including telematics and smartphone integration (Apple CarPlay, Android Auto) – features notably absent from Tesla's standard offering.

The Path Forward for Manufacturers

Vehicles have become more expensive, complex, and feature-rich, driven by regulations and technology adoption. However, production innovations, economies of scale, and complexity management have made previously premium features more accessible. This allows some manufacturers to deliver enhanced value at competitive prices.

Understanding feature value trends and consumer preferences in specific markets is crucial. JATO Dynamics highlights that leveraging comprehensive data intelligence enables manufacturers to define competitive feature sets, optimise pricing strategies, and position their products effectively based on delivering tangible ‘value for money’ – a critical factor beyond mere pricing or discounting in today's competitive landscape. This strategic approach during concept and pre-production phases is key to differentiation and success.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS