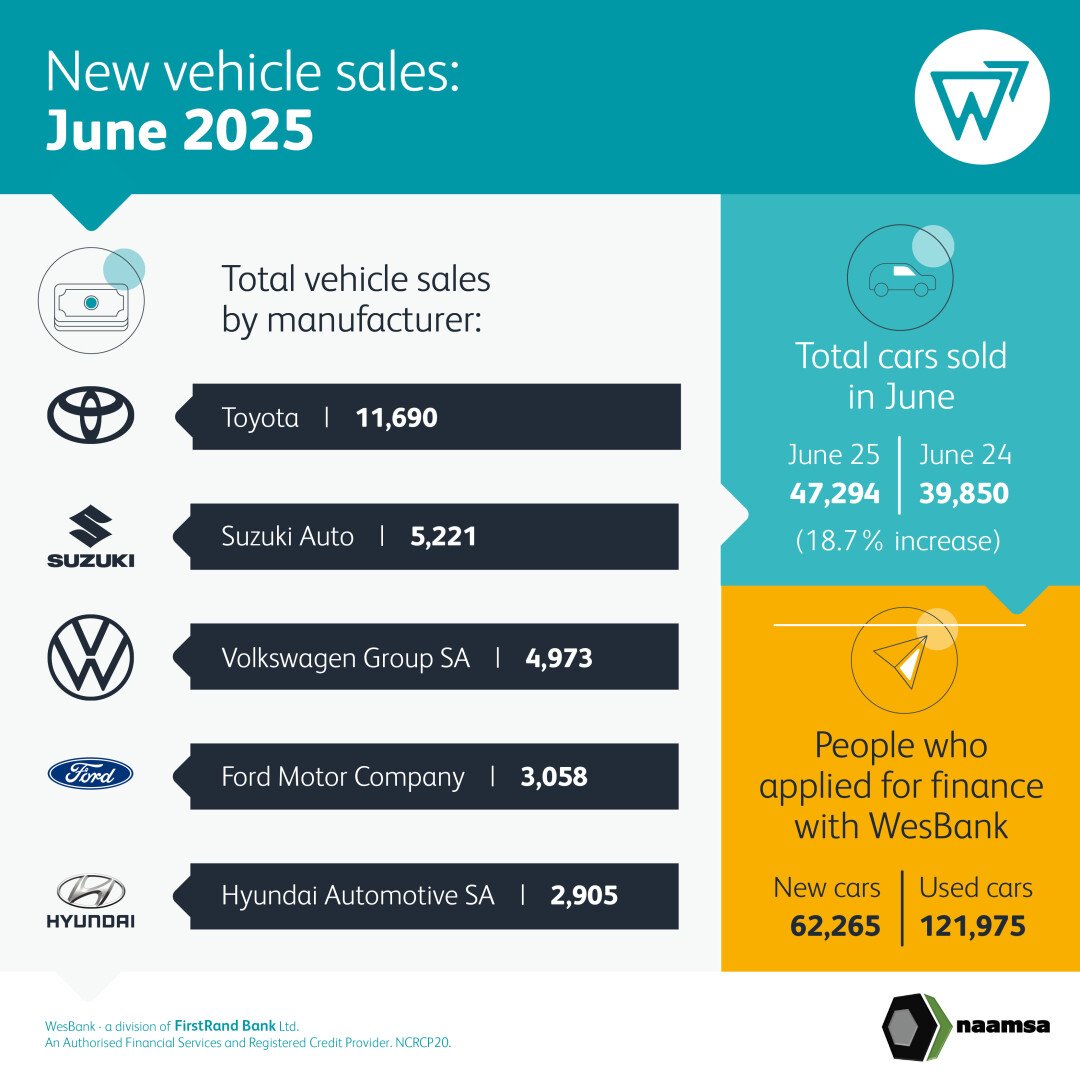

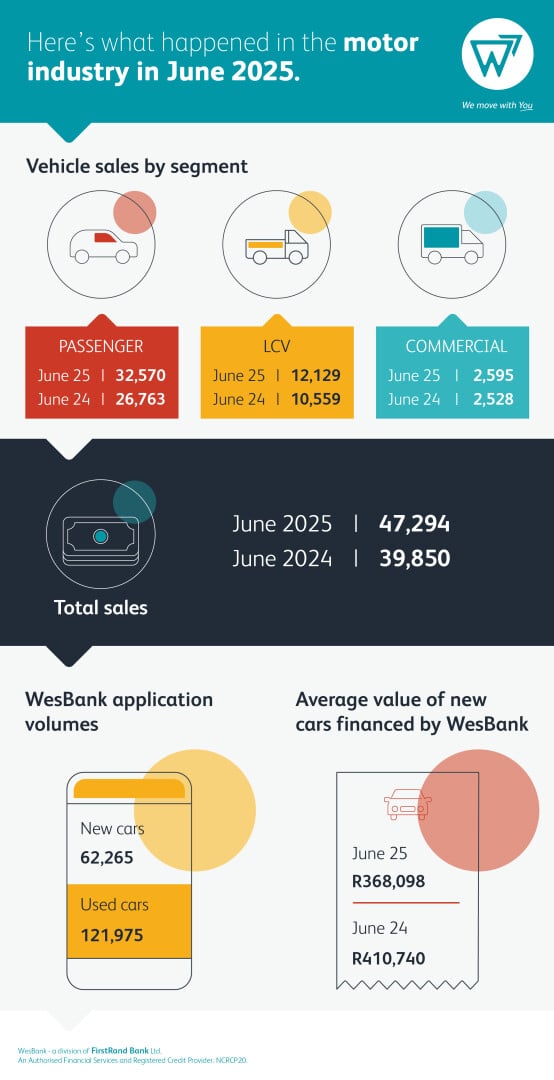

South Africa's new vehicle market sustained its robust domestic performance through June 2025, rounding off a solid first half of the year in line with earlier projections from naamsa | The Automotive Business Council. Industry sales climbed sharply to reach 47 294 units last month, marking an 18,7% increase – or 7 444 more vehicles – compared to the 39 850 units sold in June 2024. This consistent growth highlights a broad-based recovery in demand from both private consumers and fleet operators.

Dealer networks remained the dominant sales channel, accounting for an estimated 40 621 units, or 85,9%, of the total June volume. Sales to the vehicle rental industry constituted 8,2%, corporate fleets took 3,2%, and government sales made up 2,7%.

Crunch the numbers by using this handy Finance Calculator

The passenger car segment led the charge, with sales reaching 32 570 units in June. This represents a significant year-on-year jump of 21,7%, equating to 5 807 more cars sold than in June 2024. Sales to the rental sector contributed 10,7% of these passenger vehicle purchases. The light commercial vehicle (LCV) market, encompassing bakkies and minibuses, also showed healthy progress, rising 14,9% year-on-year to 12 129 units, an increase of 1 570 vehicles.

Performance in the truck segments was mixed. Medium commercial vehicle sales surged 24,7% to 652 units, up by 129 vehicles from June 2024. Conversely, the heavy truck and bus segment experienced a slight dip, declining by 3,1% (62 vehicles) to 1 943 units compared to the same period last year.

Cumulatively for the first six months of 2025, new vehicle sales stand 13,6% ahead of the same period in 2024. This growth has been significantly supported by a wave of affordable imported models. Data shows that new light vehicle imports by Original Equipment Manufacturers (OEMs) grew by 25,6% year-to-date (January to May 2025), while imports by independent distributors surged 33,4%. In contrast, domestic sales of locally manufactured models by OEMs declined by 14,0% over the same timeframe.

Looking for a safe car for a student then click here

The sustained market strength builds on momentum established since late 2024 and is underpinned by several favourable economic factors. These include decreasing interest rates following the South African Reserve Bank's (SARB) further 25 basis point cut in May 2025, a manageable inflation environment, and improved access to credit for buyers. While headline consumer inflation held steady at 2,8% year-on-year in May, comfortably below the SARB's target band, emerging risks from food inflation and oil price volatility warrant careful monitoring in the coming months.

Mikel Mabasa, CEO of naamsa, commented on the resilience: "The first half of 2025 has shown how responsive our domestic market can be. Strong consumer demand, supported by positive economic fundamentals, has helped the automotive sector deliver notable growth despite global challenges. We see this momentum as a result of supportive macro-economic policies and an adaptive industry. As 2025 marks a critical point, we look forward to progressive measures from the SAAM35 Review that sustain this trajectory, boost competitiveness, and drive inclusion."

Despite the strong sales figures, business confidence dipped in the second quarter. The BER Business Confidence Index fell five points to 40, reflecting concerns around political stability and external uncertainty. Interestingly, this sentiment shift also affected new vehicle dealers, creating a disconnect with the robust sales activity, suggesting underlying anxieties about longer-term structural and policy risks.

Starting or running a small business and in need of a bakkie – click here

On the export front, South Africa shipped 36 343 vehicles in June 2025, a 7,9% increase (2 647 units) compared to June 2024. However, significant trade uncertainty remains. The 90-day reciprocal trade reprieve granted by the United States expires on July 9, 2025. While not directly applying to automotive Section 232 tariffs, this reprieve forms part of the broader negotiation framework crucial for South Africa's preferential access to the US market.

Mabasa emphasised the strategic response needed: "Our thriving exports are vital. Current trade policy shifts, especially from the US, challenge this. We must diversify markets, expand regional trade, and advocate for fair global systems."

Looking ahead, the second half of 2025 presents a more complex landscape. While domestic sales are expected to remain healthy in the near term, fuelled by the lagged effects of interest rate cuts and resilient consumer demand – particularly for affordable, well-equipped models – challenges persist. Consumers continue to prioritise affordability, a trend reinforced by the recent improvement in the FNB/BER Consumer Confidence Index, which rebounded from -20 to -10 in Q2:2025.

The South African automotive sector concludes the first half of 2025 demonstrating significant resilience and adaptability within the domestic economy, underscored by the sustained alignment between monetary policy and industrial activity. Franchised dealers have played a central role in navigating economic, political, and global pressures to achieve this notable growth.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS