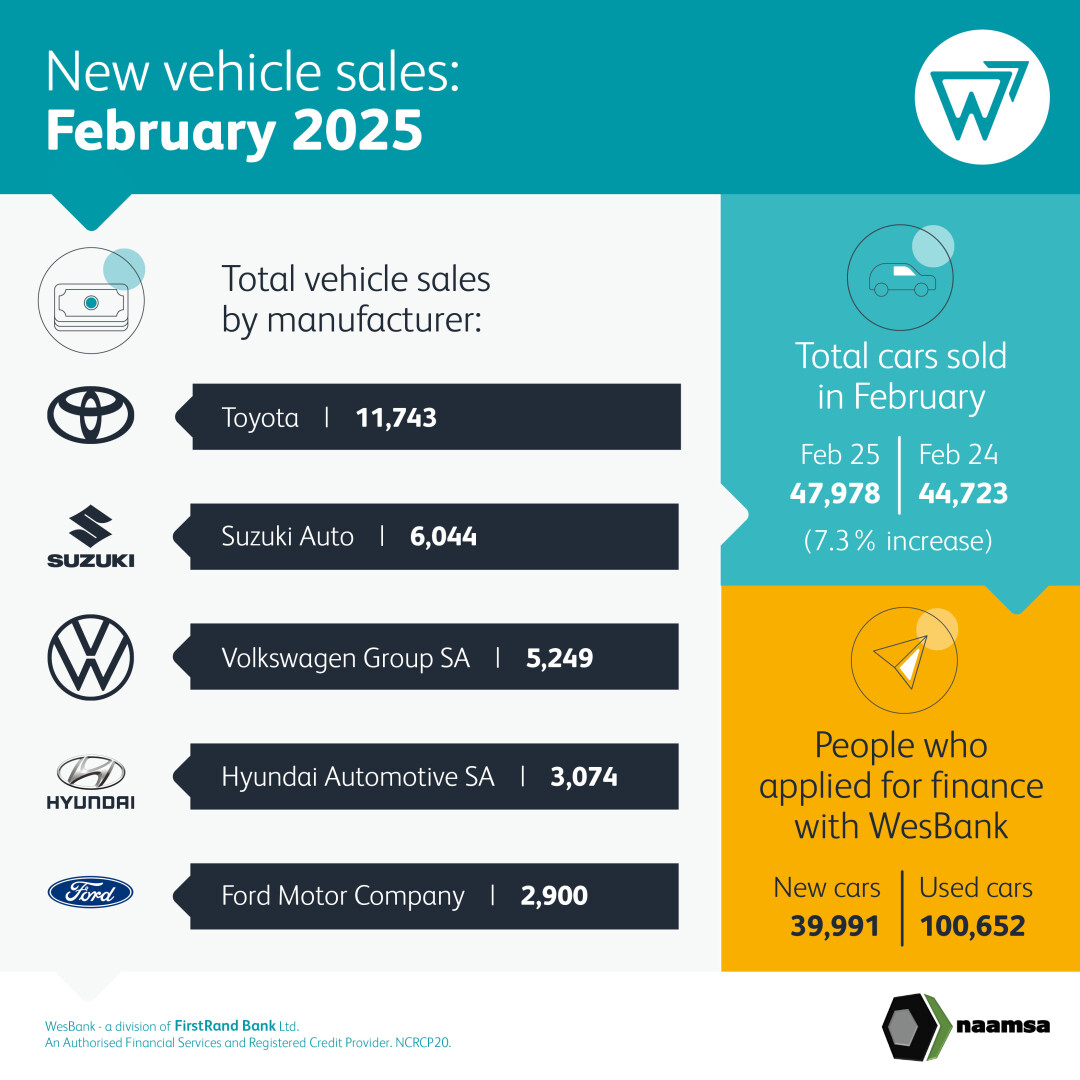

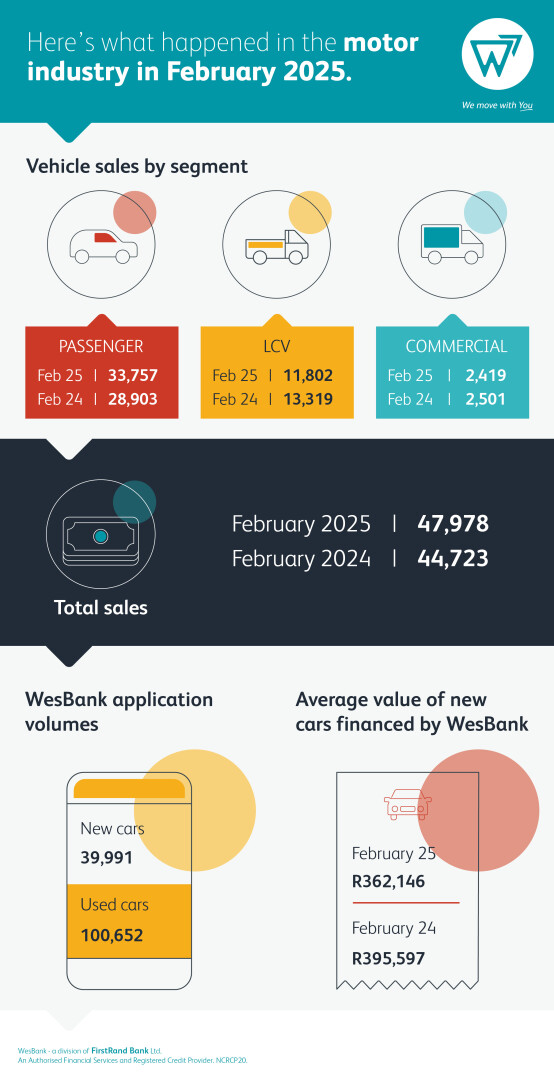

February 2025 marked a pivotal moment for South Africa’s automotive sector, with domestic new vehicle sales climbing 7,3% year-on-year to 47 978 units. This growth, driven by improved affordability and consumer confidence, contrasted sharply with an 8,6% contraction in exports, underscoring the industry’s balancing act between local resilience and global headwinds.

Buoyed by a 75-basis-point interest rate cut since September 2024 and stronger employment figures, South African consumers demonstrated renewed appetite for passenger vehicles. Sales in this segment jumped 17,0% to 33 757 units compared to February 2024, with car rental companies contributing 14,.6% of these purchases.

Naamsa CEO Mikel Mabasa highlighted the role of monetary policy, stating: “Easing borrowing costs and rising disposable incomes have made vehicle ownership more accessible, particularly for first-time buyers.”

For the very best in pre-owned vehicles just click here

Private sector credit extension grew by 4,9% year-on-year in January 2025, reflecting increased liquidity, while 132 000 jobs added in Q4 2024 bolstered household spending power. Brands such as Suzuki, Hyundai, and Chery gained traction in the entry-level market, with analysts noting that affordability-driven purchasing is reshaping buyer preferences.

“New entrants offering competitive pricing are democratising access to new vehicles,” said Lebo Gaoaketse of WesBank.

While passenger cars thrived, light commercial vehicle (LCV) sales fell 11,3% to 11 802 units, signalling caution among businesses. Naamsa attributed this to delayed fleet renewals and softer business confidence.

Medium commercial vehicles bucked the trend with an 11,8% rise to 721 units, but heavy truck and bus sales dropped 12,5% to 1 698 units, reflecting challenges in freight and public transport investment.

Need finance – click here for the very best finance deals for your new car

Brandon Cohen of the National Automobile Dealers’ Association (NADA) noted: “LCV declines are partly due to stock shortages, but broader economic uncertainty is prompting firms to defer capital expenditure.”

Vehicle exports fell to 34 656 units, down 12,3% from February 2024, as weaker demand in key markets like the US and lingering trade policy disputes disrupted shipments. Naamsa emphasised while South African manufacturers retain structural advantages in global supply chains, shifting trade dynamics require careful navigation.

Mabasa remarked: “The export dip highlights the need for agility in responding to international market conditions.”

Interested in a Toyota Corolla Cross - then click here

Domestic growth faces potential hurdles, including a 12,74% electricity tariff hike scheduled for April and the postponement of the 2025 Budget, which introduced fiscal uncertainty. However, Naamsa remains optimistic, citing sustained business confidence and the cumulative impact of interest rate relief.

Gaoaketse cautioned inflation risks could temper the pace of future rate cuts, stating: “Affordability gains from lower rates may be offset by rising energy and fuel costs, prompting households to budget cautiously.”

The used-car sector emerged as a key beneficiary of economic pressures, with TransUnion reporting used vehicle financing outstripped new car loans by a ratio of 1,56:1 in late 2024. Cohen observed, “Buyers are prioritising value, opting for smaller, non-premium models to manage costs.”

As Naamsa celebrates its 90th anniversary, Mabasa reflected on the industry’s evolution: “Our collaborative approach with government and labour has cemented South Africa’s position as a global automotive hub. Looking ahead, innovation and partnerships will remain critical to sustaining growth.”

Year-to-date sales for 2025 rose 9,5% to 94,968 units, defying earlier forecasts of sluggish growth. While domestic demand offers a robust counterweight to export challenges, stakeholders acknowledge that sustaining momentum will require navigating inflationary pressures, energy costs, and global trade volatility.

Starting or running a small business and in need of a bakkie – click here

As South Africa’s automotive sector adapts to this complex landscape, its ability to leverage domestic tailwinds while mitigating external risks will determine its trajectory in the months ahead.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS