South Africa’s automotive sector received a significant boost in May 2025, driven by a pivotal shift in monetary policy and strengthening domestic demand. The month saw the South African Reserve Bank (SARB) reduce the repo rate by 25 basis points, a move broadly welcomed as supportive for industrial growth, consumer affordability, and overall economic stability. This policy pivot followed a period of cautious holding and aligns with industry advocacy for measures to counter global and domestic pressures.

"This industry consistently navigates the forefront of global economic shifts," remarked Mikel Mabasa, CEO of Naamsa, the Automotive Business Council. "The SARB’s decision to lower interest rates arrives at an opportune moment. It directly enhances consumer purchasing power and bolsters our production competitiveness, crucial factors given the persistent uncertainty impacting our export markets."

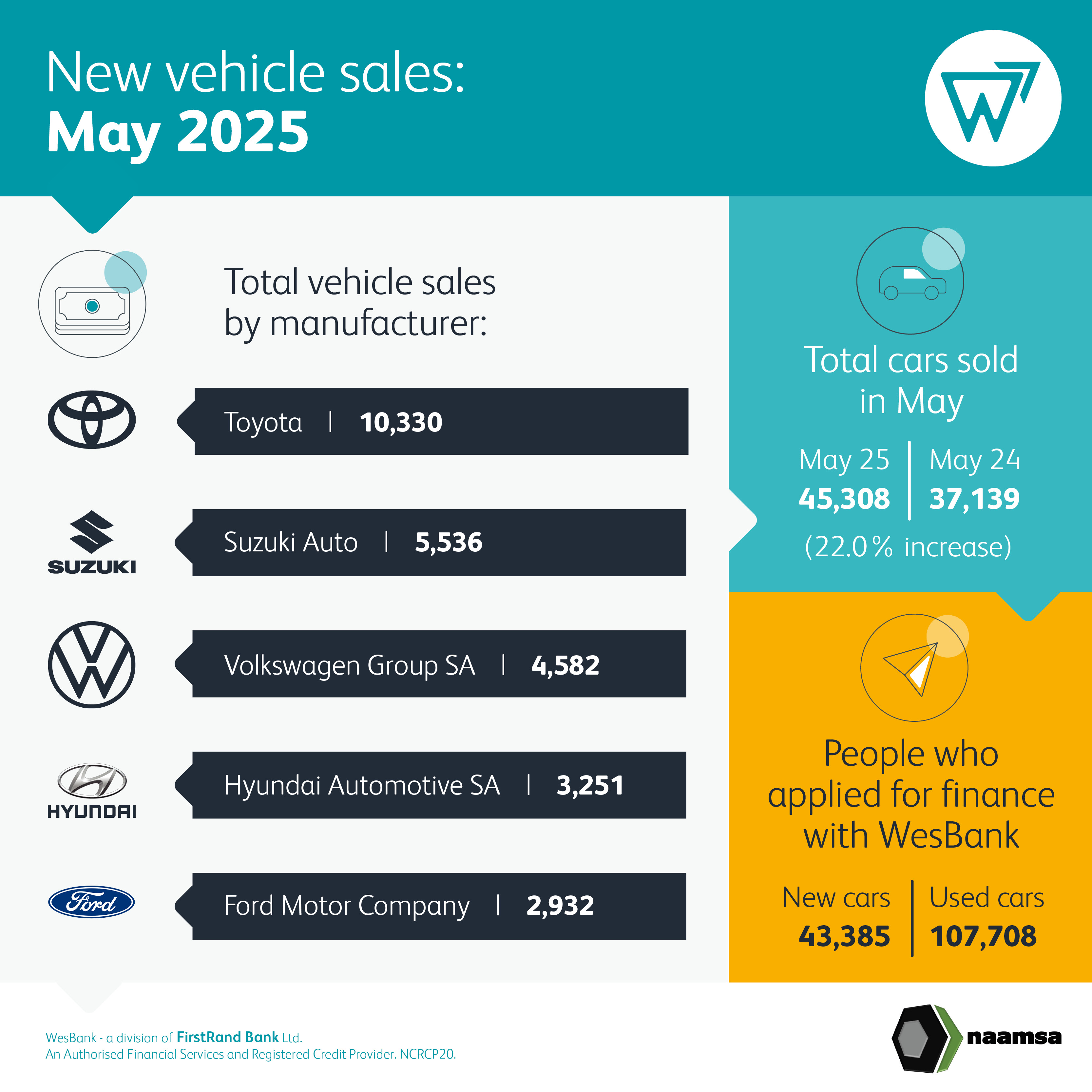

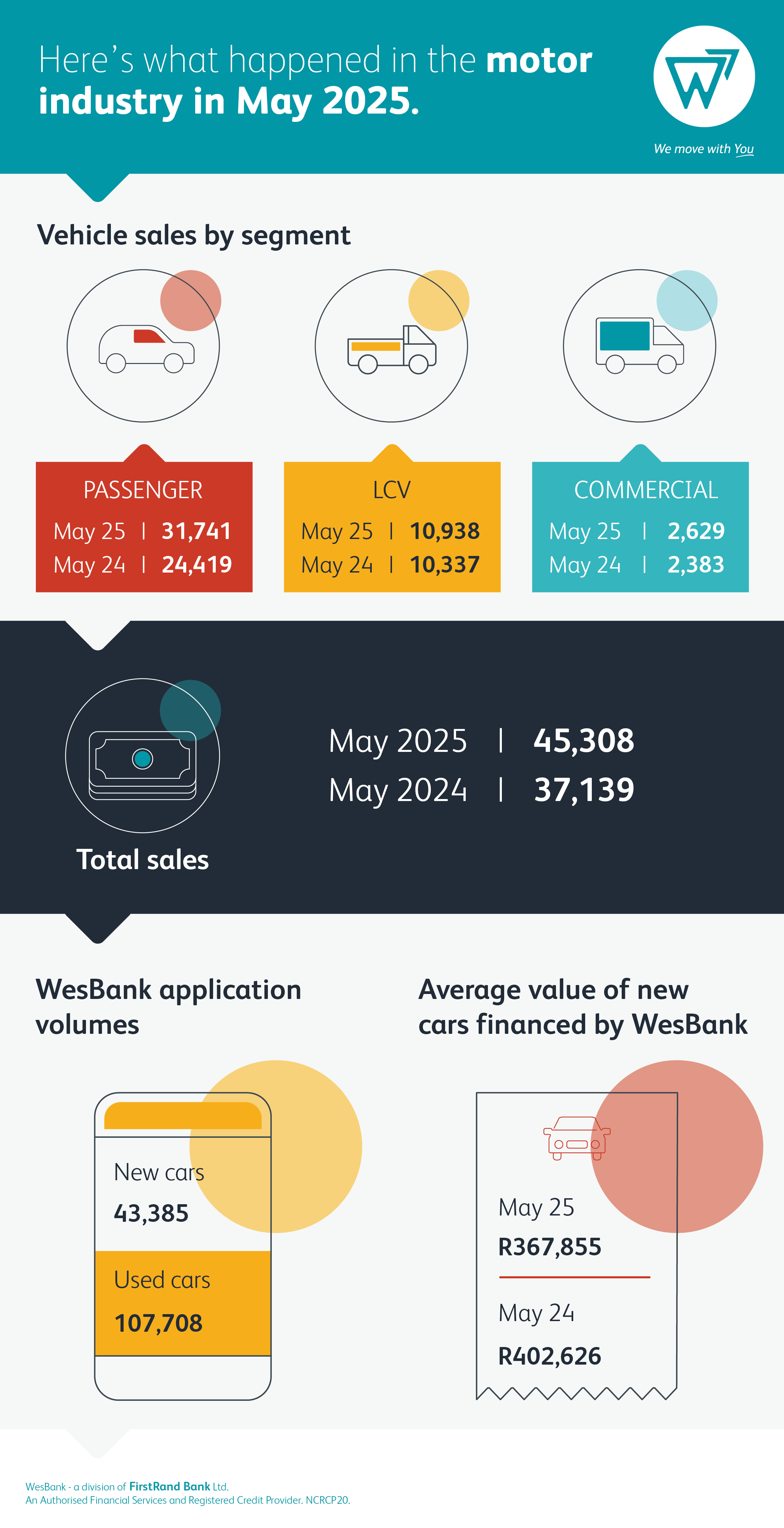

The positive sentiment translated into tangible results on showroom floors. Total domestic new vehicle sales for May reached 45 308 units, marking a notable 22,0% increase – equivalent to 8 169 more vehicles – compared to the 37 139 units sold in May 2024. Naamsa data reveals the dealer network dominated this activity, accounting for an estimated 40 062 units, or 88,4%, of the total. Sales to the vehicle rental industry constituted 6,8%, industry corporate fleets took 3,0%, and government sales represented 1,8%.

Chery has delivered 100 units of the Tiggo 4 Pro to First Car Rental. We’re proud to see more rental companies choosing Chery, not only for our vehicle’s value and safety, but also for the professionalism and responsiveness of our fleet team,” commented Siphiwe Nkutha, National Fleet Sales Manager for Chery South Africa. “We thank First Car Rental for their trust and look forward to supporting their continued success with dependable vehicles and dedicated aftersales service.”

For the very best dealer-backed choices in pre-owned cars click here

Breaking down the segments reveals broad-based growth:

- Passenger Cars: Sales surged 30,0% year-on-year to 31 741 units, up 7 322 vehicles from May 2024. Car rental companies were active buyers, accounting for 8,5% of these sales.

- Light Commercial Vehicles (Bakkies/Mini-buses): This segment recorded a 5,8% increase, selling 10 938 units – 601 more than the same month last year.

- Medium Commercial Vehicles: Sales jumped 22,7%, reaching 660 units, an increase of 122.

- Heavy Trucks and Buses: This category saw a 6,7% rise to 1 969 units, adding 124 vehicles compared to May 2024.

The SARB’s rate cut is anticipated to fuel this momentum further. It arrives amidst a gradually improving macroeconomic landscape: inflation moderated to 2,8%, comfortably within the central bank’s 3%-6% target band, and the Rand showed signs of firming alongside improved investor sentiment. Lower oil price forecasts also contribute to a benign inflation outlook. For consumers, the immediate benefit is reduced vehicle financing costs, enhancing affordability.

"The substantial rise in sales, particularly that impressive 30% jump in passenger cars, was most satisfying to see," said Brandon Cohen, National Chairperson of the National Automobile Dealers’ Association (NADA). He noted a distinct sales pattern within the month: "Activity was relatively slow during the first half of May but increased significantly in the latter half, likely influenced by the finalisation of the national budget, the interest rate announcement, and positive geopolitical developments."

Cohen added that the reported total of 45 308 units might even understate actual market activity, as only half of the Chinese brands operating in South Africa submitted their sales data to Naamsa for May.

Good insurance is as vital as safe driving – click here to find out more

The used vehicle market also presented interesting dynamics. Thembinkosi Pantsi, NADA Vice-Chairperson, observed: "May was fascinating for pre-owned. Many customers opted for aspirational brands in the used market over new vehicles, including premium models aged seven to ten years. We also saw interest in pre-owned Chinese models, suggesting buyers want to test reliability and aftersales before committing new." Pantsi also reported a noticeable increase in well-informed showroom foot traffic.

However, the export sector presented a counter-narrative. Vehicle exports dipped 14,6% in May 2025 to 30 112 units, down 5 165 from May 2024. Naamsa attributed this primarily to a temporary production halt at a major exporting manufacturer for essential plant upgrades ahead of a new model launch. Despite this monthly setback, year-to-date exports remain 1,4% ahead of 2024. The fragility of global demand amidst rising protectionism underscores the ongoing need for export competitiveness through policy alignment and market diversification.

Industry leaders view the SARB’s decision as extending beyond consumer credit. Lower borrowing costs support manufacturing investment, including crucial capital expenditure and retooling for new models. With inflation expectations easing, the real cost of capital is declining, potentially reviving vital sector investment. This aligns with the government’s "National Budget 3.0" focus on fiscal consolidation, suggesting monetary easing and fiscal responsibility can coexist to support high-multiplier industries like automotive manufacturing.

Naamsa also highlighted with interest the ongoing discussions between National Treasury and the SARB regarding a potential lowering of the official inflation target midpoint from 4,5% to 3,0%. Such a structural shift could pave the way for sustainably lower interest rates in the future, significantly benefiting affordability-sensitive consumers and manufacturers facing input costs.

As the sector celebrates Naamsa’s 90th anniversary in 2025, attention now shifts to the upcoming SA Auto Week (Eastern Cape, 1-3 October). Under the theme “Reimagining the Future, TOGETHER: Cultivating Inclusive Growth and Shared Prosperity,” the event aims to foster global engagement and investment. Bolstered by supportive policy moves and a gradually improving economic backdrop, South Africa’s automotive industry enters the second half of 2025 with renewed confidence, aiming to sustain growth across domestic sales, production, and exports.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS