The announced closure of ArcelorMittal South Africa’s (AMSA) long steel production from the Newcastle blast furnace is a significant development for the South African automotive sector. This decision has raised alarms within the industry due to AMSA's role as a major supplier of speciality steel essential for vehicle production. Without this domestic source, automakers will face considerable challenges in sourcing high-grade steel, a critical component for manufacturing automotive parts.

AMSA has been integral to the automotive supply chain, providing approximately 70 kilotons of speciality long steel annually. This steel is used in various components, from engine parts to structural elements, making its availability crucial for uninterrupted production.

The absence of a reliable local supplier could disrupt production lines, potentially leading to plant shutdowns and reduced manufacturing output.

Looking for some two-wheel mobility then click here

The need to replace AMSA's supply with imported steel introduces additional complexities, such as longer lead times and increased logistical costs. These factors could lead to delays in production schedules and higher operational expenses for automakers. Moreover, the reliance on imports exposes the industry to fluctuations in foreign exchange rates, further complicating cost management.

In light of these challenges, the automotive sector must consider alternative strategies to ensure the continuity of production. Exploring new supply sources, investing in alternative materials, or seeking technological innovations could be potential solutions.

However, such adjustments will require time and investment, presenting further hurdles for an industry already navigating a competitive global market.

The closure of AMSA's long steel production not only threatens the stability of the supply chain but also poses broader economic risks, highlighting the urgency for strategic responses from both the industry and policymakers.

Consequences for Automotive Production

The automotive industry faces significant challenges with AMSA's closure, particularly in sourcing high-grade steel locally. As the sole domestic supplier, AMSA has been responsible for approximately 70 kilotons of speciality long steel annually for the automotive sector (AMSA is the sole domestic supplier of roughly 70 kilotons per annum of speciality long steel grades to the automotive sector.. The unavailability of this steel will likely disrupt production lines, leading to potential vehicle plant production stoppages and reduced production volumes. Furthermore, the need to import steel could lead to increased operational costs, compounding the challenges faced by automakers.

Check out these Hot Sellers - click here

Economic Impacts

The economic ramifications of AMSA's closure are profound. The automotive sector is not only a major component of South Africa's manufacturing industry but also a significant contributor to the national GDP. Every 1 000 tons of steel produced in South Africa has been estimated to add R9,2-million to the GDP, supporting six jobs — three directly and three indirectly. The potential loss of these contributions, alongside the threat of approximately 13 000 job losses due to production line disruptions and increased material imports, could have a lasting impact on the economy.

Influence of Import Duties

The shift to importing steel brings the issue of import tariffs into sharp focus, potentially driving up the cost of steel for the automotive industry. The introduction of these tariffs could see steel prices increase by as much as 25%, which includes longer lead times, logistics expenses, and fluctuations in foreign exchange rates (Steel importation can increase costs by up to 25% due to longer lead times, logistics, and forex exposure.) .

These additional costs would inevitably be passed down the supply chain, impacting not only automakers but also consumers.

Manufacturers may find themselves in a position where they must absorb some of the costs, potentially squeezing profit margins and limiting their capacity for reinvestment and growth. Higher prices for steel could make it more challenging for South African automakers to compete with international manufacturers who benefit from lower production costs.

The reliance on imported steel also exposes the industry to greater financial risks linked to currency exchange rates. Fluctuations in the value of the rand could make it difficult for automakers to maintain stable cost structures, further complicating financial planning and forecasting. This volatility could necessitate the development of more sophisticated financial strategies to hedge against currency risks.

Another concern is the potential delay in supply chains due to longer shipping times and complex customs procedures associated with importing steel.

These delays could lead to interruptions in production schedules, affecting the overall efficiency of vehicle manufacturing. The necessity to stockpile more steel to mitigate against such delays could also tie up capital, which might otherwise be used for investment in technology and innovation.

Ultimately, the additional financial and logistical burdens introduced by import duties could erode the competitive edge of South African automakers, making it crucial for the industry to seek ways to mitigate these impacts through strategic planning and collaboration with policymakers.

Are you a student looking for affordable transport - click here

Industry Reactions and Adjustments

The closure of AMSA's long steel production has prompted the automotive industry to consider a range of adaptive strategies. One approach being explored is the diversification of steel sources. By expanding their supplier base to include both domestic and international providers, automakers aim to mitigate the risks associated with relying on a single source. This strategy could help stabilise the supply chain, ensuring that production schedules remain intact despite the loss of AMSA's output.

In addition to seeking alternative steel suppliers, the industry is also investigating the use of substitute materials. Advanced composites and aluminium are among the materials being considered for specific automotive components.

While these alternatives may offer benefits such as weight reduction and improved fuel efficiency, transitioning to new materials involves significant research and development costs, as well as potential changes to manufacturing processes.

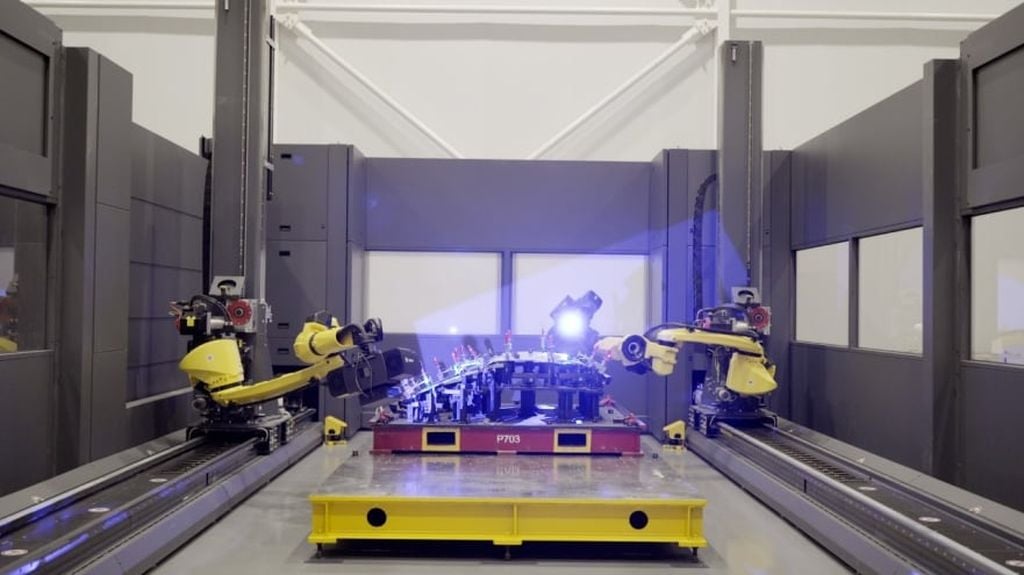

Investment in new technologies is another avenue being pursued. Automation and digitalisation could enhance production efficiency, offsetting some of the increased costs associated with importing steel. By adopting cutting-edge manufacturing techniques, automakers may be able to streamline operations and reduce waste, thereby improving overall profitability.

Collaboration within the industry is also seen as essential. Partnerships between automakers and steel producers could lead to innovations that improve material quality and reduce costs. Joint ventures and research initiatives could pave the way for new solutions that address the current supply challenges.

Training and upskilling the workforce is another critical consideration.

As the industry adapts to new materials and technologies, there will be a growing need for specialised skills. Investing in employee development can help ensure that the workforce is prepared to meet the demands of an evolving manufacturing landscape.

Government and Policy Considerations

For the very best choices in pre-owned cars click here

Government intervention could be instrumental in addressing the challenges posed by the closure of AMSA's long steel production. One critical step could be the introduction of financial assistance for companies adversely affected by the shutdown. This support could take the form of grants, low-interest loans, or tax incentives, aimed at helping automakers navigate the transition to alternative steel sources without severe financial strain.

Additionally, the government could play a role in facilitating trade agreements that reduce the cost of importing steel. By negotiating favourable terms with steel-producing countries, South Africa could secure more affordable import prices, thus mitigating some of the cost increases associated with the loss of AMSA's production. Such agreements could also streamline customs procedures, reducing delays and logistical challenges tied to importing materials.

Reviewing and adjusting import tariffs is another potential policy action. Lowering or temporarily suspending tariffs on imported steel could alleviate some of the financial burden on the automotive sector, enabling manufacturers to remain competitive despite increased reliance on imports.

This adjustment would be especially crucial in the short term, as the industry adapts to the new supply chain dynamics.

Incentivising research and development within the sector could also yield long-term benefits. By funding innovation projects, the government can encourage the exploration of new materials and advanced manufacturing techniques.

This investment could lead to the development of cost-effective and sustainable alternatives to traditional steel, enhancing the industry's resilience.

Furthermore, implementing workforce development programmes would be beneficial. As the sector evolves, there will be a need for specialised skills to work with new materials and technologies. Government-sponsored training initiatives can ensure that the automotive workforce is well-prepared for these changes, supporting a smooth transition and maintaining productivity levels.

Conclusion and Future Projections

The closure of AMSA's long steel production has undoubtedly brought significant challenges to the South African automotive sector. However, the industry's resilience and adaptability should not be underestimated. By diversifying steel sources, exploring alternative materials, and investing in new technologies, automakers have the potential to mitigate the immediate impacts and find new pathways for growth.

Collaborative efforts with the government could further enhance these initiatives, providing financial assistance and policy support to ease the transition. It is clear that the road ahead will require substantial adjustments, but these changes could also foster innovation and strengthen the sector in the long run. Strategic planning and proactive measures will be key to maintaining competitiveness and ensuring that the South African automotive industry can continue to thrive despite the challenges posed by AMSA's closure.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS