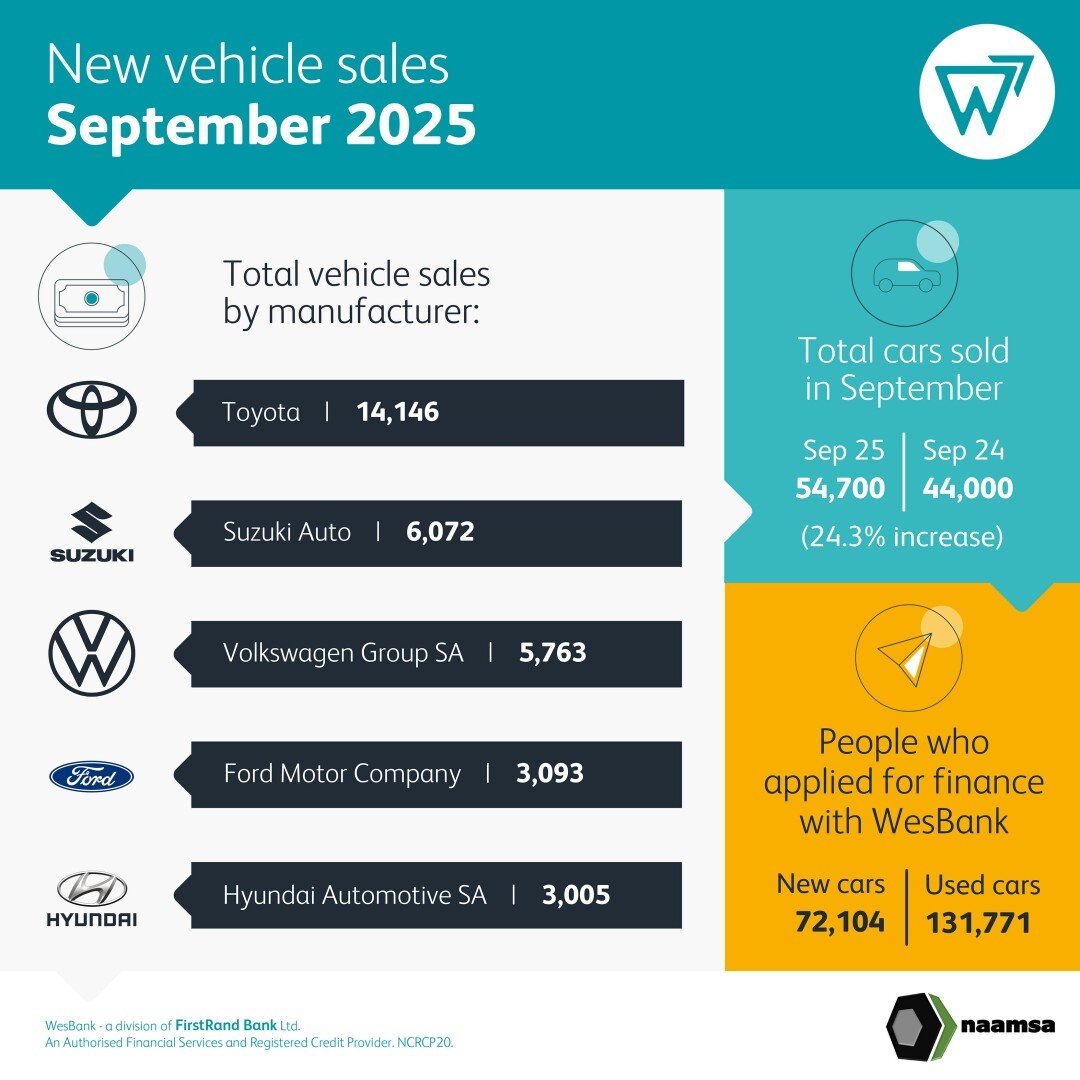

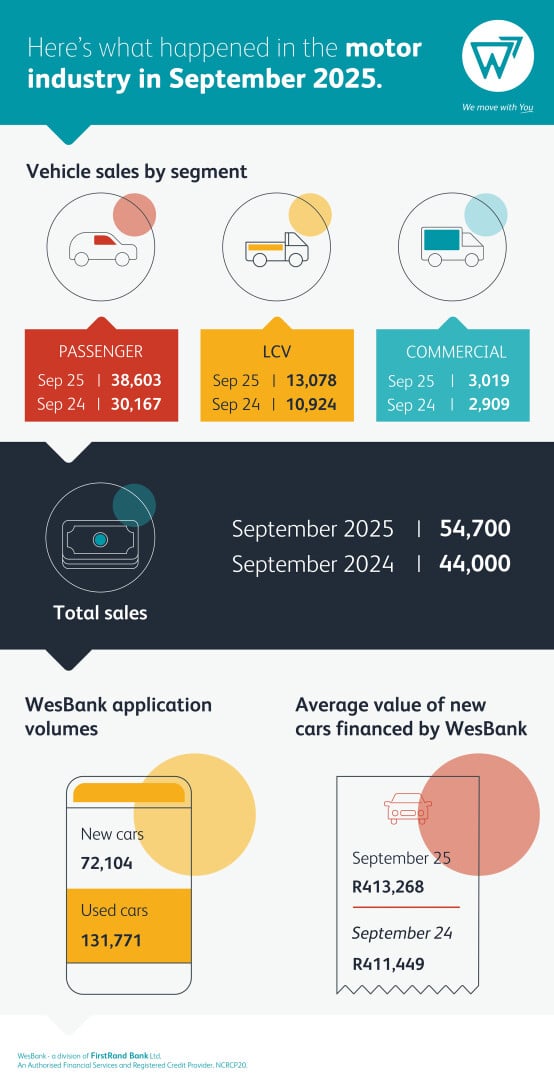

South Africa’s new vehicle sales in September 2025 were on a roll, hitting 54 700 units. That’s the strongest monthly figure the industry’s seen in 10 years and a 24% increase from the same time last year. Dealers took the lion’s share (over 80%), with rentals making up about 15%.

Fleets and government filled in the rest. Passenger cars led the pack, with 38 603 units sold—the best we’ve seen since 2014. Rentals grabbed a notable portion, claiming one out of every five new cars. Light commercial vehicles, including bakkies and minibuses, also had a strong month, with sales jumping nearly 20%. The truck segment was a mixed bag: medium trucks slipped a bit, but heavy trucks and buses saw almost 6% growth.

Need finance – click here for the very best finance deals for your new car

From a macro perspective, the economy surprised with a 0,8% GDP bump in the previous quarter, and households kept spending. But let’s not kid ourselves—Fitch’s steady rating signals long-term growth will likely stay muted, around 1,2% annually, thanks to persistent issues with investment and employment.

In short, demand is solid, but there are limits. On the inflation front, there’s some relief. Consumer inflation cooled to 3,3% in August, thanks to lower food, fuel and transport costs. Car price inflation stayed tame, helped by a stronger rand and stiffer competition, which is good news for buyers—especially in the small and entry-level brackets.

The Reserve Bank kept rates steady at 7%. They’re holding firm, aiming to anchor inflation at the lower end of the target range. Earlier rate cuts have supported car sales, but another cut would do wonders for stimulating higher-value purchases.

Starting or running a small business and in need of a bakkie – click here

Consumer confidence softened in Q3, especially among the middle class, who are feeling the squeeze from sluggish job growth and rising food costs. Still, the durable goods index ticked up a bit, showing that there’s appetite for big purchases when financing is in reach.

Speaking at naamsa’s 2025 SA Auto Week conference, newly appointed WesBank CEO Robert Gwerengwe underscored the critical need for industry collaboration to propel the local automotive sector past the persistent 500 000-unit annual sales ceiling.

“Collaboration is key to advancing the industry beyond its current levels, and naamsa deserves immense credit for its role in bringing together industry stakeholders and even competing brands to solve for South Africa’s mobility challenges and chart a sustainable growth path,” said Gwerengwe. “A vibrant automotive sector provides South Africans access to a reliable and convenient means to go to work or school, or anywhere they need to be to pursue their economic empowerment goals.”

“Confidence and sentiment are both looking good for South Africa’s vehicle market – both new and used,” said Brandon Cohen, Chairperson of the National Automobile Dealers' Association (NADA). “US Dollar weakness is helping the Rand, which will contribute to new vehicle pricing stability for some time to come.”

Crunch the numbers by using this handy Finance Calculator

Toyota South Africa Motors (TSAM) reaffirmed its market leadership with an exceptional retail performance in September, recording 14 146 new vehicle sales and securing a 26% market share out of the industry’s 54 700 units sold. This is Toyota’s best monthly performance since March 2022, when the company last surpassed the 14 000 mark.

Exports continue to be a bright spot. The trade surplus held at R20.3 billion in July, driven by robust commodity and agricultural exports, which stabilized the rand and kept imported auto component costs in check. Still, the sector faces risks from increased petroleum imports and shifting trade conditions, like US tariffs. Vehicle exports surged 33% compared to last September, with almost 39 000 units shipped out. Year-to-date, exports are up 6% over 2024.

That’s impressive, considering all the global supply chain hiccups and external trade pressures. At the 2025 SA Auto Week, WesBank’s new CEO, Robert Gwerengwe, emphasized the need for industry-wide collaboration to finally break past the 500,000 annual sales mark. He credited naamsa for bringing together key players and even rival brands to address mobility challenges. Bottom line: South Africa’s auto sector is showing strong sales and export growth, but longer-term momentum will depend on tackling structural constraints and fostering more collaboration across the industry.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS