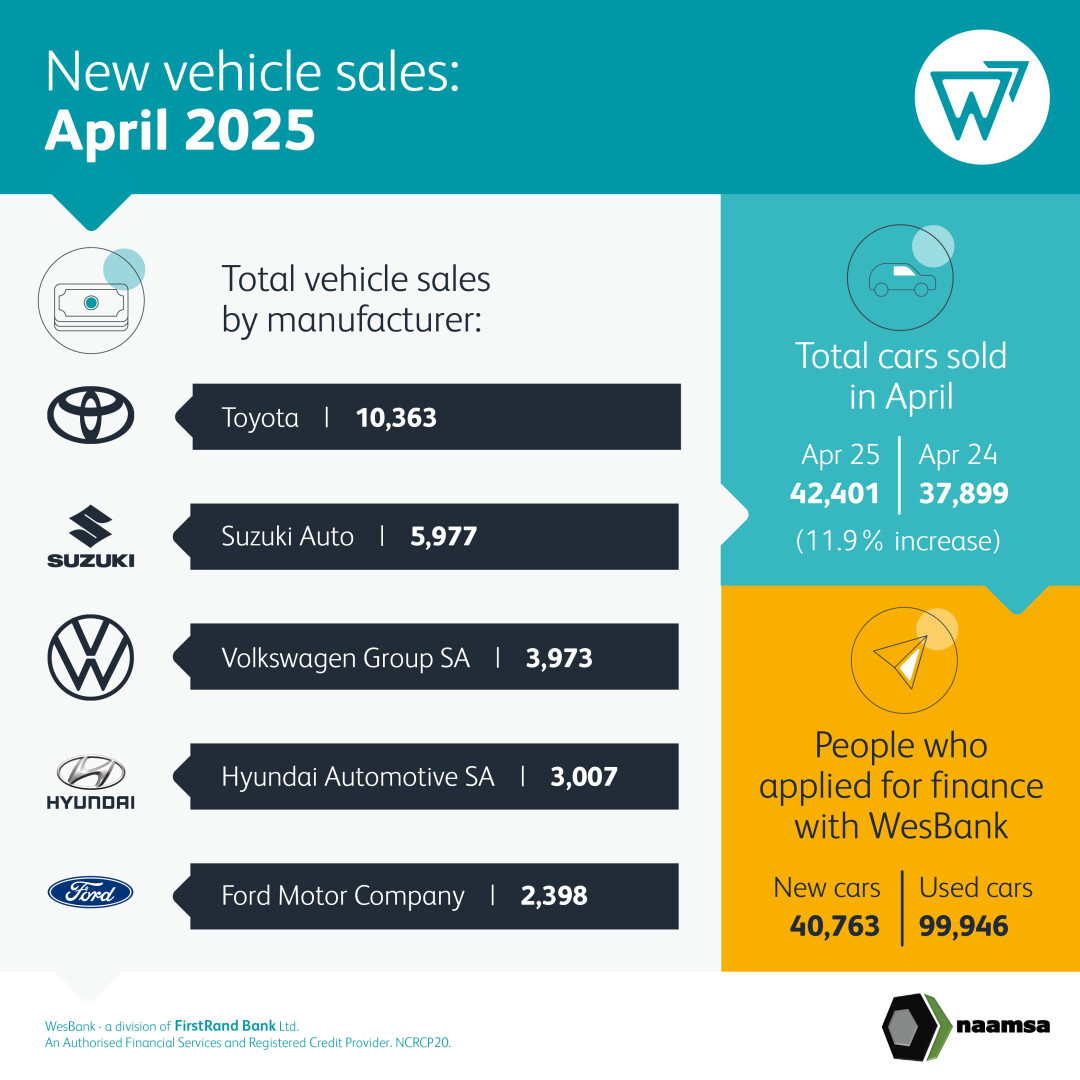

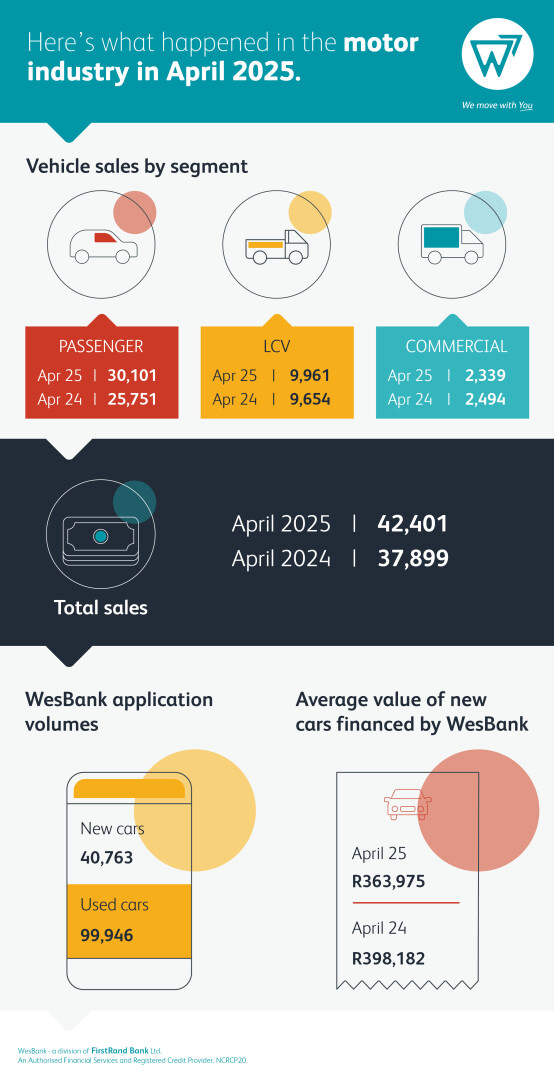

South Africa’s automotive sector flexed its adaptability in April 2025, navigating choppy global economic waters with characteristic grit. Despite mounting trade tensions and a tricky domestic landscape, the industry clocked a hearty 11,9% year-on-year rise in domestic new vehicle sales, reaching 42 401 units. Export figures dipped slightly by 6,6% to 31 822 units for the month, though year-to-date exports remained 6,3% ahead of 2024 levels.

“Our sector thrives on transformation,” remarked Naamsa CEO Mikel Mabasa. “While US tariff shifts pose hurdles, South Africa’s export agility and competitive edge keep us anchored. We’ve weathered storms before – this time’s no different.”

For the very best deal on pre-owned cars click here

Dealers drove the lion’s share of April’s sales, accounting for 87,9% (37 258 units), while rental firms, corporate fleets and government purchases made up 7,0%, 2,7% and 2,5% respectively. Passenger car sales revved up by 16,9% to 30 101 units, with rental companies snapping up 8,9% of these. Light commercial vehicles also nudged upwards by 3,2% (9 961 units), though heavy truck sales skidded 11,1% amid supply chain tweaks.

The month wasn’t without its potholes. Fewer selling days due to public holidays, a brief return of load-shedding and VAT policy jitters tested resolve. Yet consumer confidence got a boost as inflation cooled to 2,7% in March – a six-year low – and government backtracked on hiking VAT.

“Stability’s creeping back,” Mabasa noted. “Lower fuel and education costs are easing household budgets, though global headwinds may push inflation up later this year.”

Export markets felt the squeeze of US trade turbulence. President Trump’s 232 tariffs – including a 30% levy on South African vehicles – initially rattled supply chains. Though suspended for 90 days (excluding China), the measures threaten long-term access to a key market.

“AGOA’s tariff-free access was a game-changer,” Mabasa stressed. “These duties demand bold recalibration.”

Starting or running a small business and in need of a bakkie – click here

Amid the challenges, local innovation accelerated. Ford South Africa reported a 9,4% Q1 sales bump, buoyed by Ranger bakkie demand and the new plug-in hybrid model – the first South African-built vehicle exported to Australia and New Zealand.

“Customers want value and flexibility,” said Ford’s Ryan Searle, citing a shift towards budget-friendly options and hybrid tech.

Looking ahead, Naamsa’s 90th anniversary and October’s SA Auto Week in the Eastern Cape promise to spotlight the sector’s reinvention. Under the theme Reimagining the Future, TOGETHER, the event aims to galvanise investment in green tech and inclusive growth.

“April’s numbers prove our sector’s tenacity,” said NADA’s Brandon Cohen. “Passenger cars and LCVs are leading the charge, but affordability remains key. We’re cautiously optimistic – the road ahead demands both grit and grin.”

Good insurance is as vital as safe driving – click here to find out more

With 186 433 vehicles sold year-to-date (10,6% up on 2024), South Africa’s motoring industry remains a study in resilience. As global trade maps redraw, its ability to blend pragmatism with innovation could yet steer it toward smoother tarmac.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS