For South Africans navigating the second-hand car market, understanding the protections offered by the Consumer Protection Act (CPA) is essential. This legislation fundamentally reshaped the relationship between suppliers and consumers, including those purchasing pre-owned vehicles. Knowing when the CPA applies and what it demands is key to a fair deal.

Lizelna Lombard, WeBuyCars, Head of Legal, has this to say: “The CPA governs the entire lifecycle of consumer transactions: the promotion (advertising and marketing), the transaction itself (the sale or lease agreement) and the goods or services supplied – including that used bakkie, sedan, or SUV you're considering.

Looking for a safe car for a student then click here

“Crucially, while the underlying credit agreement from a bank falls under the National Credit Act, the vehicle being financed remains firmly within the CPA's scope. The Act generally protects all individual consumers and juristic persons (like companies or trusts) with an annual turnover below R2-million. However, important exceptions exist, particularly concerning product safety.

“Sections 60 and 61 of the CPA empower the National Consumer Commission (NCC) to recall unsafe goods, such as a vehicle with a known fire risk, regardless of the buyer's turnover threshold. Similarly, suppliers face liability if unsafe goods cause harm, irrespective of who purchased them. This underscores the CPA's core focus: establishing clear consumer rights and corresponding supplier obligations.”

Honesty is Non-Negotiable in Marketing

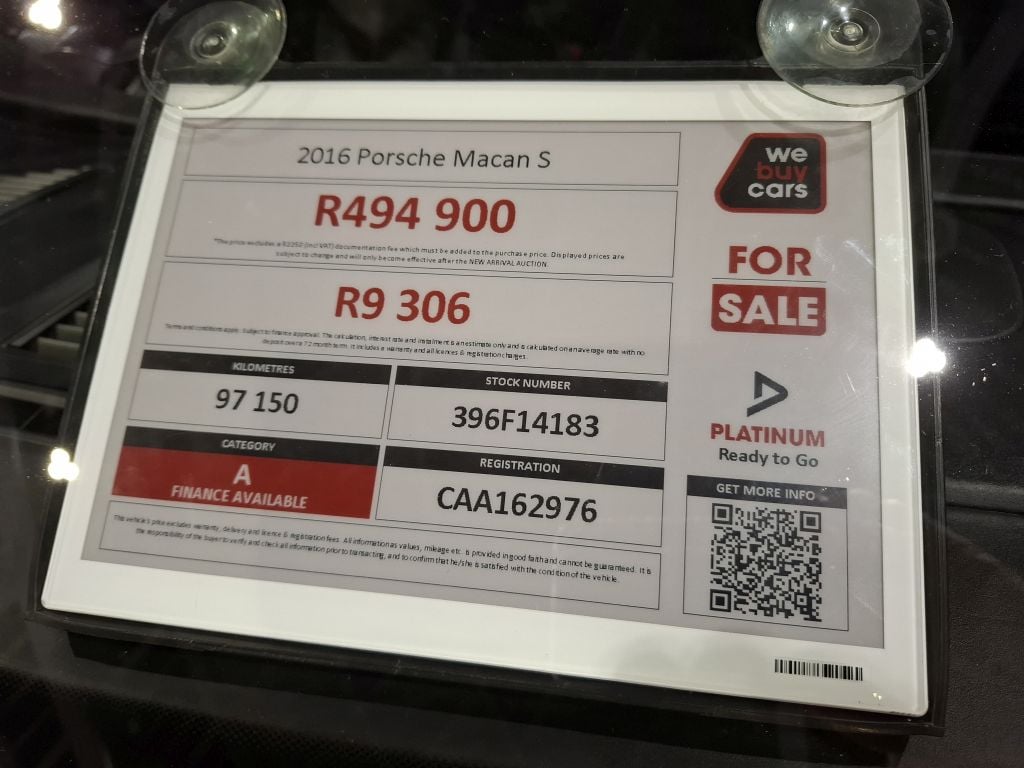

The CPA demands truthfulness from the start. Section 29 prohibits false, misleading or deceptive advertising. Dealers cannot misrepresent a car's condition, mileage, features, accident history or fuel efficiency. Advertising that car as ‘pristine, one careful owner’ when it’s been in a significant accident is a clear violation. Prices displayed must be accurate, avoiding hidden costs.

Every vehicle on the floor at WeBuyCars carries a sticker with a QR Code that links directly to the cell phone app. Buyers can scan the code and will get a detailed breakdown of the vehicle and ANY faults found during the three-inspection (including the independent one by Dekra).

Great insurance is as vital as safe driving – click here to find out more

Respecting Your Privacy

“Direct marketing – contacting you specifically via phone, SMS or email to sell – carries strict rules under Section 11,” adds Lombard. “Consumers have the right to refuse such contact. While a national opt-out registry is planned, suppliers must currently honour direct requests to stop marketing (‘opt-out’) or visible signage (like a ‘no junk mail’ sticker).

“Marketing calls are prohibited on Sundays, public holidays, Saturdays before 9 am or after 1 pm, and on weekdays before 8 am or after 8 pm. A unique CPA protection allows consumers a 5-day cooling-off period to cancel a purchase only if it resulted directly from direct marketing, enabling a full refund upon returning the goods.”

Fair Dealing and Your Right to Choose

Section 40 guards against unconscionable conduct. Sales tactics involving coercion, undue pressure, harassment or physical force are illegal. Furthermore, Section 14 prevents suppliers from ‘bundling’ goods or services unfairly (eg forcing you to buy expensive aftermarket accessories to secure the car) unless it offers genuine consumer convenience, economic benefit or the items are also sold individually.

Need two wheels to get you there and back - click here

The Heart of Used Car Protection

“This is paramount for used car buyers. Unless you were explicitly informed about specific defects and agreed to buy the car ‘as is’ with those known faults,” stresses Lombard.

The CPA implies a warranty that the vehicle is:

- Reasonably suitable for its general purpose (eg driving on public roads).

- Of good quality and in good working order.

- Free of defects – apparent or latent (hidden).

- Durable for a reasonable period, considering its age, mileage, and price.

- Compliant with applicable safety standards.

- Fit for any specific purpose you made known to the dealer before purchase (eg ‘I need it for frequent long highway trips’).

“Critically, suppliers cannot contract out of these requirements. This implied warranty exists alongside any express warranty offered by the dealer.”

Your Remedies if Things Go Wrong

If the vehicle fails to meet these standards within six months of delivery, the CPA (Section 56(2)) gives you the right to demand the supplier, at your choice:

- Repair the vehicle.

- Replace the vehicle.

- Refund the price paid.

The landmark case Renault South Africa (Pty) Ltd v Windsor highlighted the courts' interpretation. While the Supreme Court of Appeal (SCA) found minor issues like a faulty Bluetooth or tissue holder compartment in a new Renault did not make the vehicle fundamentally unacceptable or unusable under the CPA, the principle remains robust: significant defects affecting safety, drivability, or core function within six months entitle the buyer to these remedies. The High Court initially emphasised a ‘robust approach’ against large corporations exploiting consumers.

Starting or running a small business and in need of a bakkie – click here

The ‘Voetstoots’ Clause

The traditional ‘voetstoots’ (sold ‘as is’) clause, aiming to absolve sellers of liability for defects, faces severe limitations under the CPA. The National Consumer Commission's case against Western Car Sales made it clear: a supplier cannot rely on a voetstoots clause to escape liability for defects covered by the implied warranty, particularly latent defects not disclosed to the buyer.

“While such clauses might theoretically still apply in transactions falling outside the CPA (like sales to large businesses above the R2-m threshold) or after the initial six-month CPA warranty period for latent defects under common law (as seen in cases like Burchmore), their effectiveness within the core CPA consumer protection sphere is drastically reduced,” says Lombard.

“Western Car Sales was found in breach for failing to refund a consumer whose vehicle broke down days after purchase due to undisclosed gearbox issues and for threatening the consumer with storage fees.”

Key Takeaways for Used Car Buyers

- Check CPA Applicability: You're generally covered if you're an individual or a small business (<R2-m turnover).

- Demand Honest Ads: Question claims about condition and history. Verify independently if possible.

- Understand the Implied Warranty: The dealer guarantees the car meets basic standards of quality and function for a reasonable period, unless specific known defects were disclosed upfront.

- Know Your Six-Month Right: Significant problems arising within six months entitle you to repair, replacement, or refund.

- ‘Voetstoots’ Isn't a Shield: Dealers cannot hide behind this clause to avoid liability for undisclosed defects covered by the CPA.

- Report Issues: Contact the dealer immediately in writing if problems arise. If unresolved, escalate to the National Consumer Commission or relevant Motor Industry Ombudsman.

“The CPA provides substantial protection, but it requires consumers to be aware of their rights and suppliers to conduct their business with transparency and fairness. Knowing these provisions empowers you to navigate the used car market with greater confidence,” she says.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS