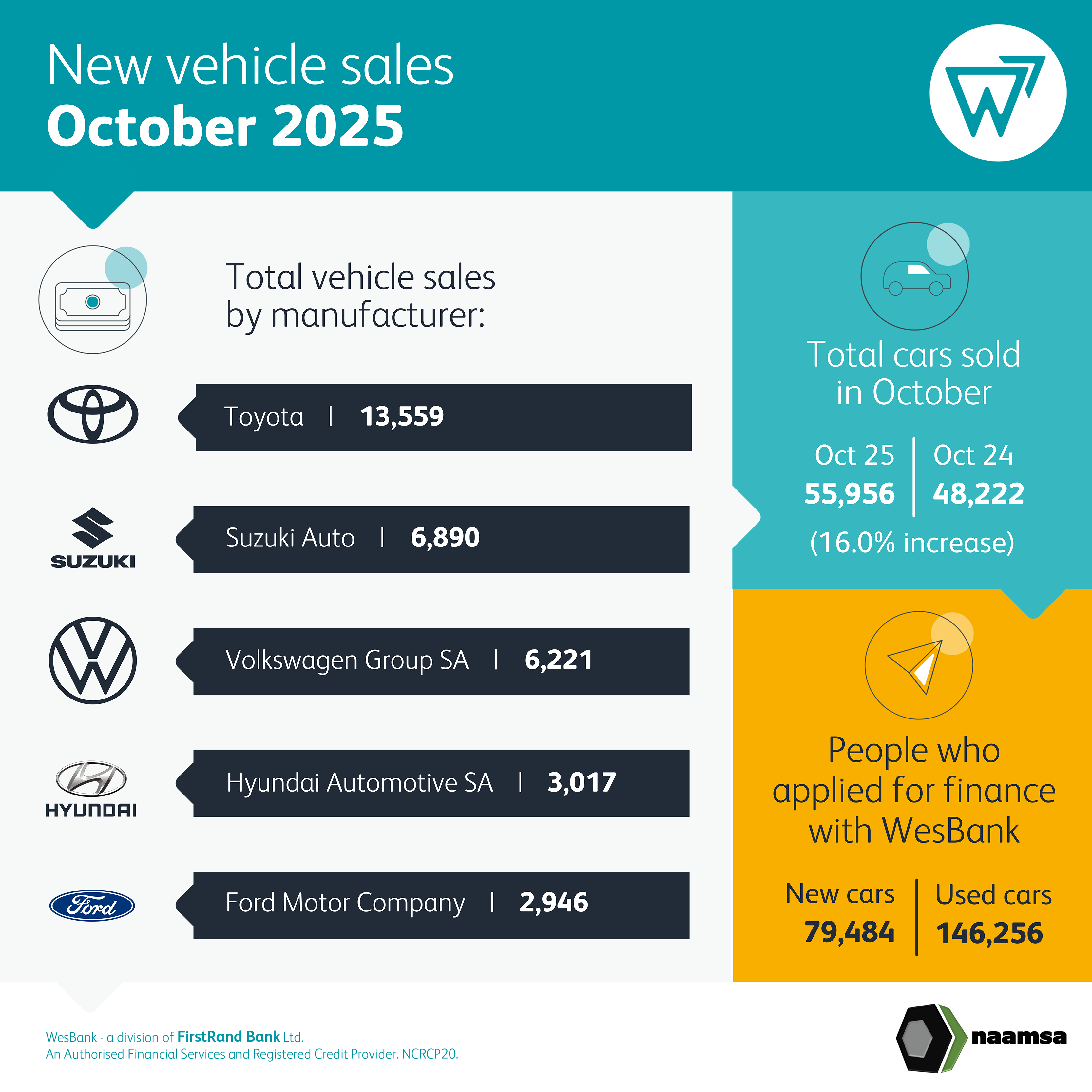

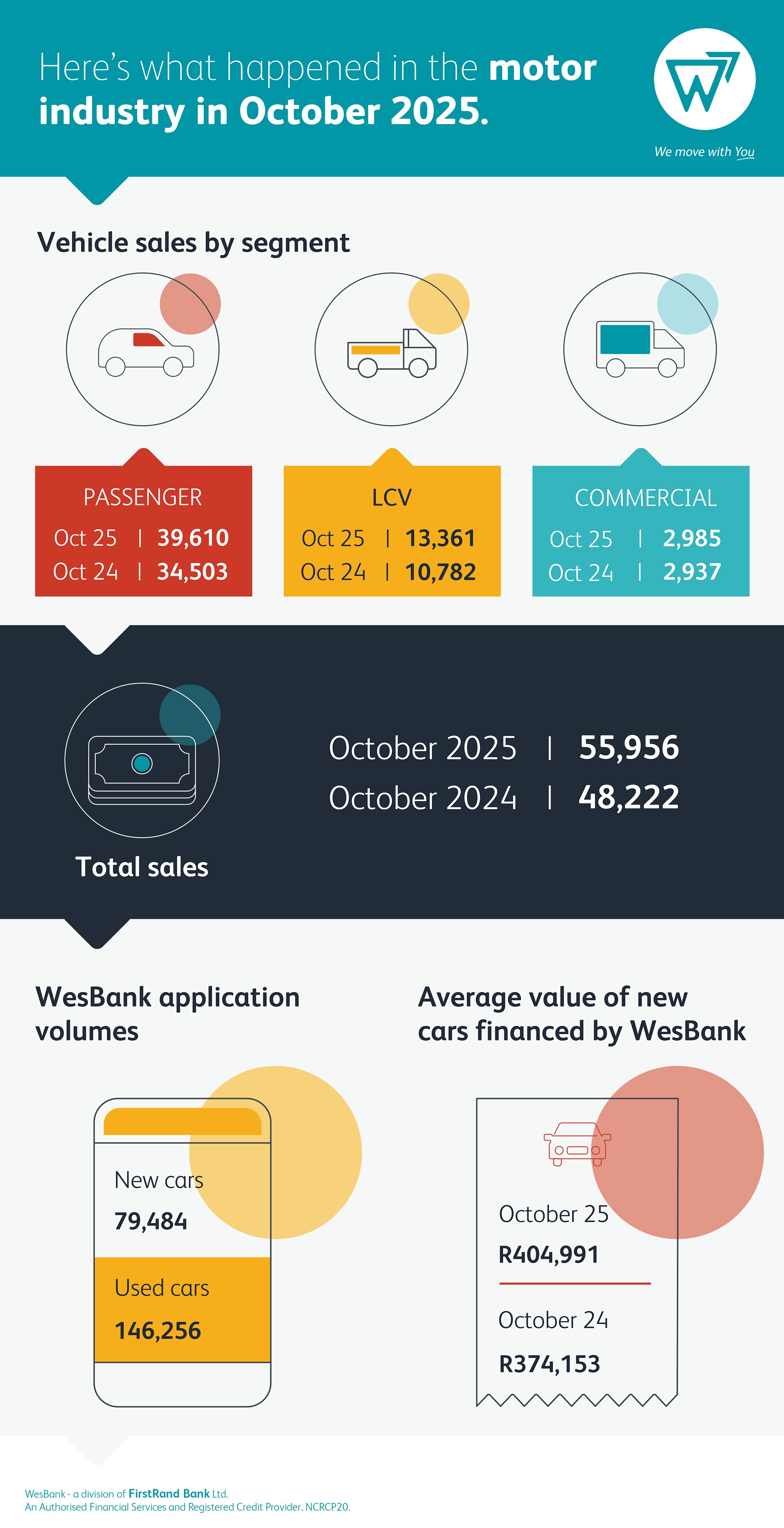

South Africa’s new vehicle market hit its highest levels in yonks with aggregate October domestic sales reaching 55 956 units. This total reflects a 16,0% increase, or 7 734 more vehicles, compared to the 48 222 units sold in October 2024, signalling sustained demand as the year enters its final quarter. Year-to-date, the market remains 15,7% ahead of the same period in 2024.

The sales distribution for October showed an estimated 44 278 units, or 79,1%, were channelled through dealer sales. The vehicle rental industry accounted for 16,6% of the total, while government purchases made up 2,2% and industry corporate fleets accounted for 2,1%.

For a great selection of truly affordable vehicles just click here

A closer look at the segments reveals a robust performance in passenger cars, which recorded 39 610 units, the highest monthly volume since October 2014. This represents a 14,8% increase from the 34 503 units sold in October 2024. Car rental companies were a significant driver ahead of the peak travel season, constituting 21,7% of all passenger car sales. The light commercial vehicle segment also showed considerable strength, with sales of bakkies and mini-buses rising 23,9% to 13 361 units from 10 782 units a year earlier.

The commercial vehicle sector presented a mixed picture. Medium commercial vehicle sales increased by 9,3% to 809 units, while the heavy truck and bus segment saw a slight decrease of 1,0%, settling at 2 176 units.

Starting or running a small business and in need of a bakkie – click here

This automotive performance is set against an improving macroeconomic backdrop. Headline consumer inflation held steady at 3,4% in September, supported by ongoing food disinflation and a firmer currency. This environment has helped improve real income dynamics for households. While the South African Reserve Bank maintained its repo rate at 7,0% in September, financial markets are anticipating interest rate reductions in early 2026, which would support big-ticket consumer spending.

On the international front, vehicle exports saw a modest increase of 0,5% in October, reaching 32 659 units. For the year to date, export volumes remain 6,7% ahead of 2024 levels, underscoring the sector’s resilience in global markets.

"The combination of easing inflation, a firmer rand and less pressure at the petrol pump has made vehicle ownership feel attainable again," says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. "The industry’s performance this year shows how improving sentiment and a more confident economy are translating directly into mobility decisions."

Looking for a safe car for a student then click here

WesBank notes the growth is not just about volume but also a shift in buyer behaviour. "Demand remains high, but the buying behaviour behind it has evolved," says Gaoaketse. "Consumers are coming back to the showroom with calculators in hand. It’s less about excitement and more about smart, sustainable choices that fit long-term budgets."

Brandon Cohen, National Chairperson of the National Automobile Dealers’ Association (NADA), added: "Foot traffic in franchised dealerships was encouraging throughout October. Interest rate cuts earlier this year, easing fuel prices and a stronger rand have all helped improve affordability at the point of sale."

Looking ahead, the market is expected to hold steady into the year-end, supported by promotional events and continued currency stability. "There are still uncertainties ahead," Cohen says, "which include the upcoming interest rate decision and broader macroeconomic pressures, however, consumer appetite for new vehicles remains resilient."

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS