March 2025 saw South Africa’s automotive industry achieve notable growth in domestic vehicle sales and exports, signalling resilience despite persistent macroeconomic pressures. The sector’s performance was bolstered by stable inflation, recorded at 3,2% year-on-year in February, and earlier monetary policy adjustments that eased financing conditions for consumers.

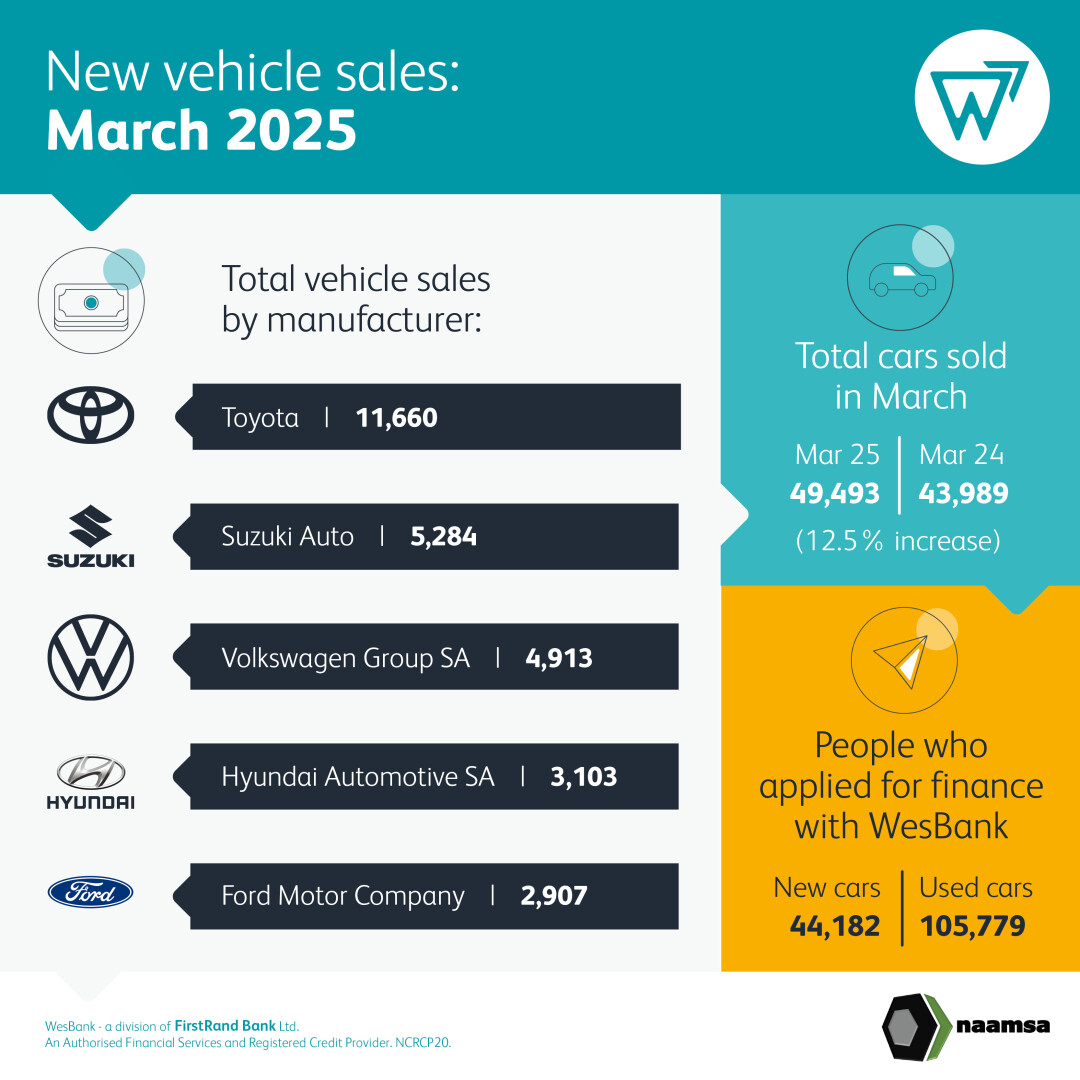

Toyota again topped the sales charts with Suzuki firmly in second place ahead of Volkswagen.

Looking for a safe car for a student then click here

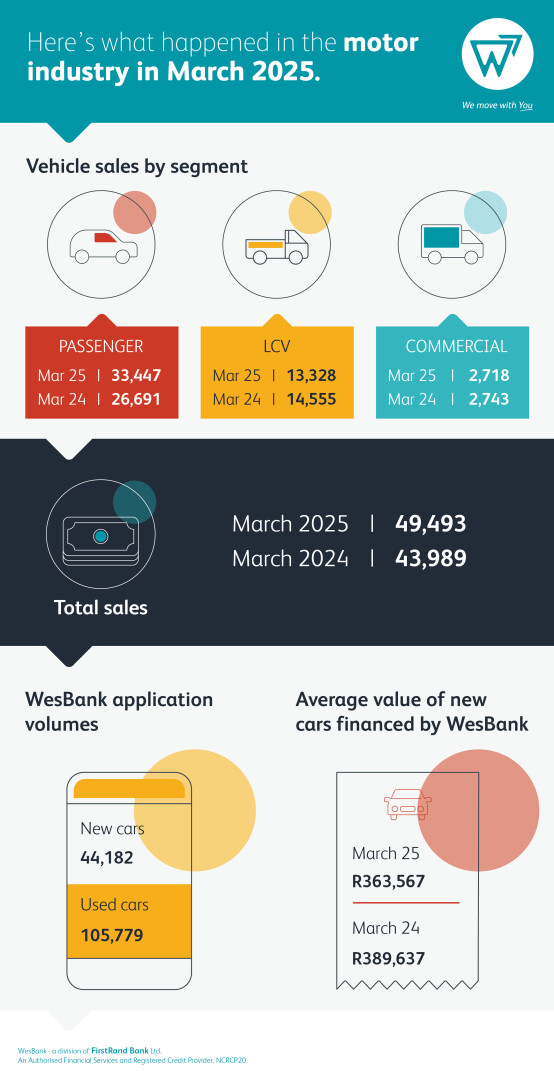

Domestic new vehicle sales rose by 12,5% compared to March 2024, with 49 493 units sold. The passenger car segment drove this growth, climbing 25,3% to 33 447 units, attributed to improved consumer demand and accessible credit.

Meanwhile, export sales increased by 31,1% year-on-year to 39 477 units, marking the first upturn in ten months. This rebound coincided with recent geopolitical developments, including concerns over US trade policy impacting South African exports, yet the sector demonstrated adaptability in maintaining its global trade presence.

Mikel Mabasa, CEO of automotive industry body Naamsa, noted the export recovery underscored the sector’s capacity to navigate economic complexities. “The industry’s export-led growth model continues to support industrial expansion and employment, even amid shifting global dynamics,” he stated.

The South African Reserve Bank (SARB) held the repo rate steady at 7,5%, aligning with international efforts to stabilise borrowing costs. However, challenges such as ongoing energy shortages, rising living expenses, and an impending VAT hike in April could test the sector’s momentum.

Starting or running a small business and in need of a bakkie – click here

As Naamsa marks its 90th anniversary, the organisation emphasised the industry’s evolution and readiness to address future challenges, including technological advancements and shifting consumer preferences. Further reinforcing this commitment, Naamsa announced the 2025 SA Auto Week (SAAW), scheduled for October 1-3 in the Eastern Cape. The event, themed “Reimagining the Future, TOGETHER: Cultivating Inclusive Growth and Shared Prosperity”, aims to attract investment, strengthen international partnerships, and advance South Africa’s manufacturing capabilities.

A detailed breakdown of March 2025 sales revealed that dealerships accounted for 86,8% of domestic transactions, followed by rental companies (7,3%), government (3,5%) and corporate fleets (2,5%). Light commercial vehicle sales declined by 8,4%, while medium and heavy truck segments saw marginal decreases of 1,8% and 0,5%, respectively.

Despite these mixed results, the automotive sector’s ability to adapt to economic cycles and external pressures positions it as a cornerstone of South Africa’s industrial strategy, with stakeholders cautiously optimistic about sustained growth in the coming years.

Brandon Cohen, National Chairperson of the National Automobile Dealers Association (NADA), noted this performance was particularly encouraging for the retail sales channel, following a robust 17% year-on-year increase in February.

Need finance – click here for the very best finance deals for your new car

“The resilience in new vehicle sales is evident, despite ongoing financial constraints for consumers. The growing pressure on financial institutions to approve credit is influencing purchasing behaviour, while rising electricity costs and fluctuating fuel prices continue to strain household budgets. Nevertheless, new car sales remain buoyant, particularly in the lower market segments, with medium car sales remaining stable.”

“Historically, we have seen that in financial downturns such as those in 1998/99, 2007/08, and 2019/20 have led to a marked shift towards used vehicles as more affordable options. However, this trend is not as pronounced in the current environment, with strong growth in new vehicle sales instead,” said Cohen.

“While the pending increase in VAT only amounts to R500 per R100 000 we expect that some purchase decisions will have been accelerated by its imminent implementation,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “While interest rates remained unchanged during the month, their levels have alleviated some affordability, stimulating demand in the market for new vehicles. WesBank has also experienced a reduction in balloon amounts financed year-on-year, reinforcing the positive improvements in affordability in the market.”

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS