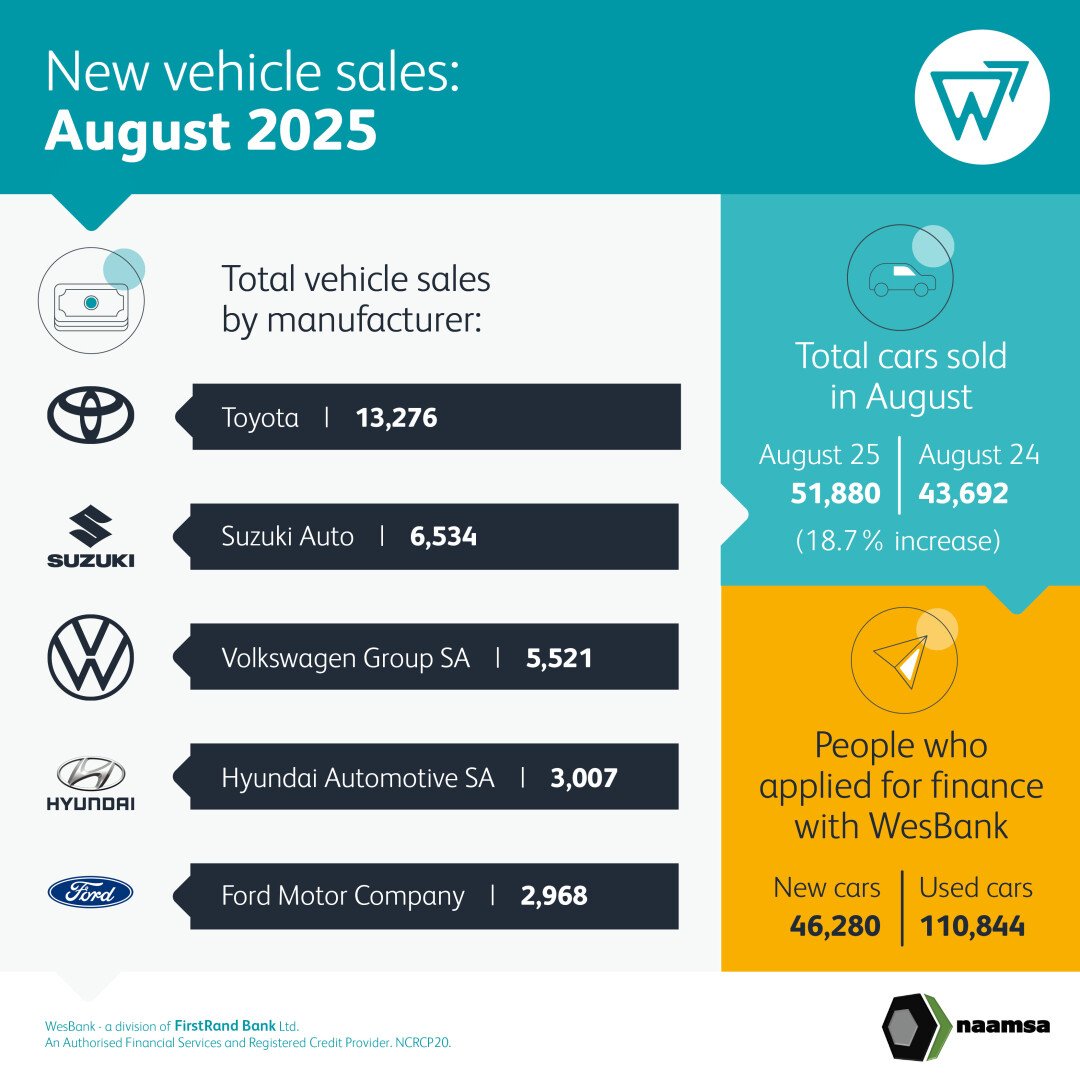

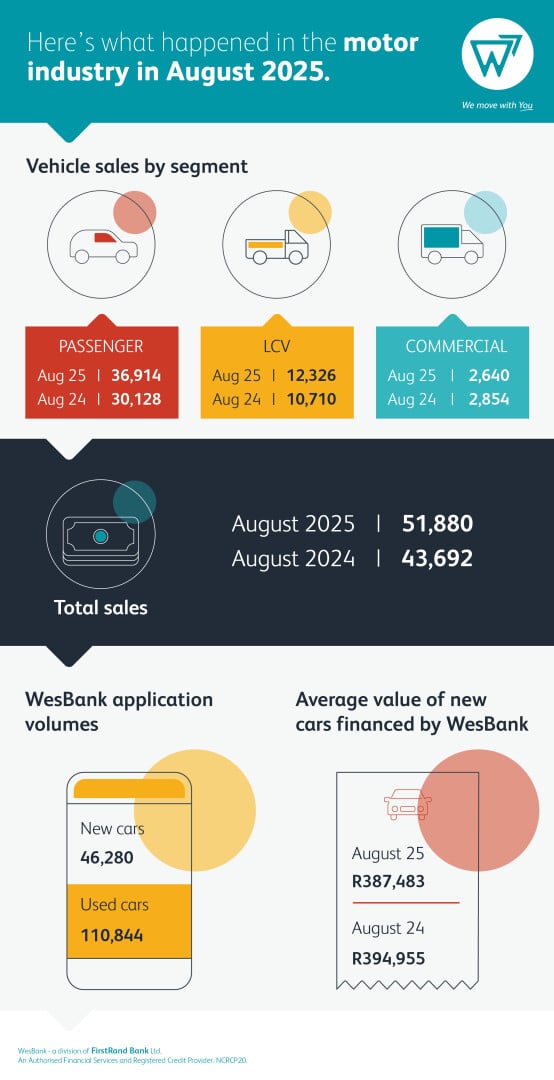

South Africa’s new vehicle market maintained its robust performance in August, with domestic demand continuing to be the primary engine of growth for the automotive sector. According to data from naamsa | the Automotive Business Council, aggregate new vehicle sales reached 51 880 units, an increase of 18,7% compared to the same month last year.

This represents the market’s eleventh consecutive month of growth and the second month in a row that sales have surpassed the 50 000-unit mark, indicating a return of substantial stability. The passenger car segment was a key driver of this performance, recording its strongest month since September 2015 with sales of 36 914 units. Light commercial vehicles, including bakkies and minibuses, also saw healthy growth, with 12 326 units sold.

Looking for a safe car for a student then click here

Lebo Gaoaketse, Head of Marketing and Communication at WesBank, noted that favourable economic conditions are supporting this momentum. “The market has been driven by demand for passenger cars,” said Gaoaketse. “More favourable conditions are improving sentiment, driven by lower interest rates and lower inflation, which is alleviating pressure on household budgets. This is freeing up pent-up demand.”

The recent reduction in the repo rate by the South African Reserve Bank is cited as a key factor, having lowered financing costs for households and made credit more accessible for vehicle purchases. Ryan Seele, an executive member of the National Automobile Dealers’ Association (NAADA), confirmed the positive trend on the ground. “We saw noticeably higher traffic on dealer floors, with the majority of buyers being private individuals,” he said. “Many are beginning to feel relief from the recent interest rate cuts.”

The market composition showed a strong preference for affordability, with locally produced models like the Toyota Corolla Cross and Volkswagen Vivo leading the sales charts. Meanwhile, vehicle export volumes also saw an increase of 6,2% in August, though the sector continues to adjust to higher tariff barriers in key international markets.

Starting or running a small business and in need of a bakkie – click here

In contrast to the positive car and bakkie sales, the medium and heavy truck segments experienced a softer month. Seele attributed the decline in heavy commercial vehicles to subdued activity in sectors like coal mining, where transport operations have been scaled back.

Attention now turns to the upcoming SA Auto Week 2025, to be held in Gqeberha from 1 to 3 October. The event will serve as a platform for the industry to forge new alliances and discuss strategies for inclusive growth and market diversification. The new vehicle sales figures for October are scheduled to be released during this gathering.

Colin Windell for Colin-on-Cars in association with

proudly CHANGECARS